Table of Contents

Get our free local reporting delivered straight to your inbox. No noise, no spam — just clear, independent coverage of Marblehead. Sign up for our once-a-week newsletter.

The Marblehead Finance Committee challenged the projected scope of the town’s fiscal 2027 budget gap at its first meeting since last week’s State of the Town address, with the chair requesting detailed data before accepting the figures as a basis for action.

Finance Committee Chair Alec Goolsby told Finance Director Aleesha Benjamin that the committee’s December forecast had identified a gap of approximately $6.8 million. He said school spending assumptions in that forecast projected an increase of roughly $1.5 million, well above the $870,000 school-side increase cited at the Jan. 28 State of the Town, where Town Administrator Thatcher Kezer presented an overall gap of approximately $8.5 million. That reduction should have narrowed the gap, Goolsby said, not widened it.

“Something happened in this analysis we did in the fall to go up by like $3.5 million,” Goolsby said.

He requested a department-by-department summary rolling into the $53.7 million town-side spending total. Benjamin said she sent that data during the meeting.

“It’s just numbers on a piece of paper to me right now,” Goolsby said of the figures presented to date.

Members drew a firm line between their role and that of town leadership.

Right now, 99 readers support The Marblehead Independent with recurring monthly or annual contributions, helping us keep doing this work as fiscal 2027 decisions come into view. This reporting turns up records into context you can actually use before votes are cast. Click here to become an Independent member.

“We are not the preparers of the town wide budget,” Goolsby said, placing responsibility for assembling a balanced spending plan with the Select Board and Kezer.

Benjamin confirmed she had directed departments to submit level-funded budgets adjusted only for contractual obligations — not spending plans reflecting cuts needed to reach balance. She said she was close to completing a balanced proposal and expected to present it to the Select Board within one to two weeks. Committee Vice Chair Molly Teets said the gap between where the process stands and where it needs to be concerned her.

“I’m just worried about timing, because there’s a lot of work that needs to be done,” Teets said.

Health insurance, fixed costs drive much of the growth

Health insurance dominated the cost discussion. Benjamin said she applied a 15% projected rate of increase to premiums — the low end of estimates that range as high as 18% — based on guidance from the Group Insurance Commission, which sets rates for municipal employees statewide. She said the increase would consume nearly all of the $2.1 million the town gains annually in property tax revenue under Proposition 2½ limits. The GIC has not voted on fiscal 2027 rates, and Nunley-Benjamin said she expected that vote in February or March.

Goolsby noted the committee had used a 10% factor in December, meaning the adjustment to 15% accounts for part of the gap’s growth. Committee member Eric Knight said he was concerned the final increase could exceed the projection, citing prior years in which the GIC surprised municipalities with late adjustments.

Goolsby requested a breakdown of costs by plan type, enrollment and department. Nunley-Benjamin said she would provide department-level detail by the end of the week.

Goolsby said the pension contribution increases $462,735 in fiscal 2027 on an actuarial schedule. Benjamin said the town will not be fully funded until 2036, ahead of a state mandate of 2040. The trash collection contract, cited at $844,575 during the State of the Town, has since been negotiated to approximately $800,000, she said.

Position cuts could exceed initial estimates

Benjamin said balancing the budget without new revenue would require eliminating more than 50 town-side positions but that the actual total could be higher because laid-off employees are entitled to 30 weeks of unemployment compensation. The town would realize only about five months of savings per position in the first fiscal year, she said, forcing deeper cuts. Knight asked whether the effective total could reach 75. Benjamin said “quite possibly” and that she was still calculating.

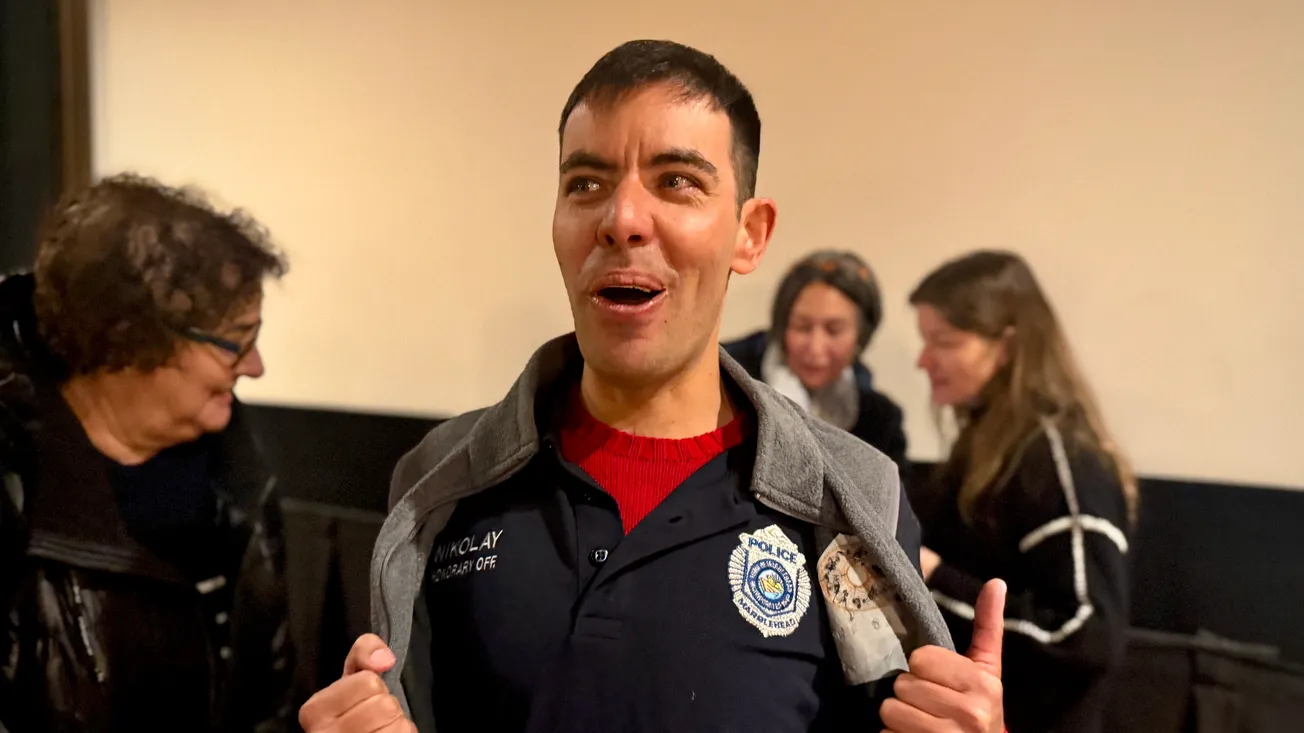

She said over 184 workers are funded through the general fund, excluding enterprise fund employees. Benjamin said she had begun classifying departments as essential or nonessential, placing fire, police and the Department of Public Works in the first category and departments such as parks and recreation and the library in the second. She did not present a final count of positions subject to elimination.

Goolsby cautioned against publicizing specific totals before the committee had reviewed the underlying data.

“I don’t think it’s healthy to talk about eliminating 50 positions before we have signed off on these numbers, is all I’m saying,” he said.

Committee delays formal review, weighs schedule changes

Goolsby recommended delaying formal liaison meetings by approximately two weeks, saying it would not be productive to review spending requests the town cannot fund until the finance director and town administrator had identified where cuts would fall.

He also proposed consolidating the committee’s three Monday-night budget hearing sessions into a single all-day Saturday meeting, tentatively March 28, to give town leadership more time before the April 6 warrant hearing. Several members expressed support, but the committee did not vote on the proposal.

The committee made no formal decisions beyond approving prior meeting minutes. Members did not vote on any budget figures, endorse any override strategy or adopt a schedule for budget hearings. No public comment was offered.

Goolsby said the committee would reconvene in approximately two weeks.