Table of Contents

BOSTON — Secretary of the Commonwealth William F. Galvin is urging Massachusetts residents preparing to file their 2025 tax returns to review recent changes in federal tax law that could significantly affect their filings.

Under a tax reform package signed into law in July, taxpayers who itemize deductions may now deduct up to $40,000 in state and local tax payments, a sharp increase from the previous $10,000 cap. The expanded deduction is expected to benefit homeowners with high property tax bills as well as residents with substantial state income tax obligations.

Galvin said many taxpayers may not be aware that property taxes, auto excise taxes and state income taxes can all count toward the deduction, subject to the new cap and certain income limits.

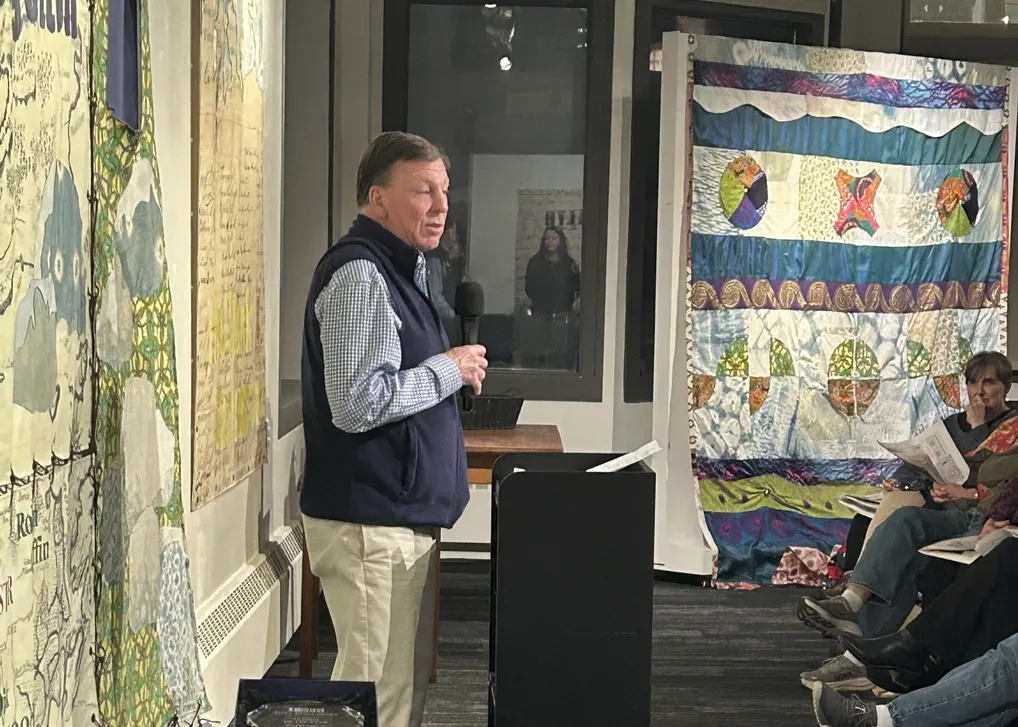

“Many taxpayers may not realize that their property tax, auto excise tax, and state income tax can all be deducted, subject to the $40,000 cap and certain income limits,” Galvin said. “Now is the time, at the beginning of the New Year, to consider your options and perhaps consult with a tax professional, to decide whether you should itemize your deductions to take advantage of this tax break.”

Galvin, whose office oversees most registries of deeds in Massachusetts, regularly provides guidance to property owners on tax-related issues, including abatements, refinancing and homestead protections. Additional information is available on the secretary’s website at www.sec.state.ma.us.