Table of Contents

Get our free local reporting delivered straight to your inbox. No noise, no spam — just clear, independent coverage of Marblehead. Sign up for our once-a-week newsletter.

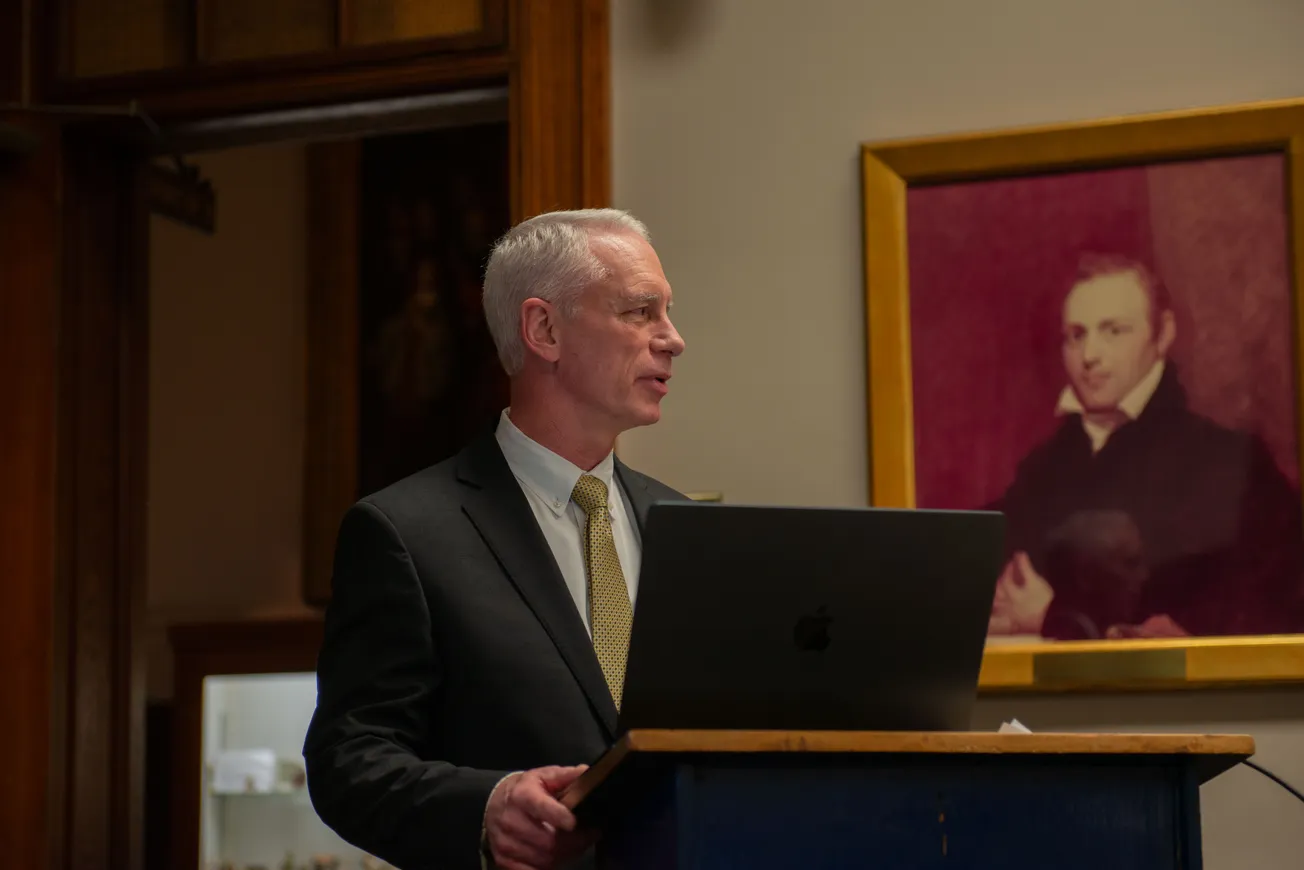

Closing Marblehead’s $8.47 million budget gap without new revenue would require eliminating more than 50 town positions, representing approximately 15 percent of the municipal workforce, Town Administrator Thatcher Kezer said during his third State of the Town address Wednesday night.

Kezer used the presentation to outline how officials might structure a Proposition 2½ override if the community chooses to pursue one, framing the discussion as an opportunity for voters to weigh in on service levels and priorities.

The projected shortfall reflects a gap between rising fixed costs and available revenue within a municipal budget of roughly $120 million, according to figures presented to town officials.

“We are down over $2.2 million in revenue to build the budget,” Kezer said.

How an override would be approached

Rather than presenting a single up-or-down funding request, Kezer said any override would be structured to give voters clear choices about service levels, priorities and affordability.

“What level of service Marblehead wants to sustain — reduced, level or enhanced?” Kezer said. “In other words, if we’re going to do an override, is it simply to have enough for reduced services from where we are? Or do we want to try to achieve level service where we are, or do we want to improve some areas of what we do?”

Kezer said the framework discussed with officials envisions an override that would spell out which services and positions could be restored or protected; whether the measure would be temporary or multi-year; and how costs would be balanced against community priorities and tax impacts. He also emphasized transparency in how options would be presented to voters.

“How do we structure an override to provide meaningful choices and full transparency so the citizens making the decisions know exactly what they’re deciding for or what is truly at risk in that choice?” Kezer said.

He said discussions have included whether an override would aim only to maintain existing services or also allow targeted improvements, including increased investment in maintaining town-owned historic buildings.

“One of the areas we’ve been talking about is the maintaining of our historic buildings,” Kezer said. “Increasing the building maintenance resources in people and dollars so that we can preserve the wonderful buildings for another generation.”

Kezer said affordability remains a central concern.

“Always the issue about raising taxes,” he said. “There are those who can absorb it, and there are those who don’t. And that’s always the challenge.”

“Ultimately, it’s a community conversation about values,” Kezer added. “What does the Marblehead we want look like and how are we willing to support it?”

During a subsequent exchange with the Select Board, Kezer clarified that any staffing cuts required under a no-new-revenue scenario would apply only to town-side employees, not school staff. Decisions about school staffing levels would be made by the School Committee.

Town-side cost increases

On the town side, expenditures are projected to increase by about $5.96 million in fiscal 2027, driven largely by fixed cost increases rather than new programs or service expansions.

Three major cost drivers account for more than half of that increase. Health insurance costs are projected to rise by $1.95 million, reflecting an estimated 15 percent increase. Pension obligations will add another $462,735, and a new trash collection contract will cost an additional $844,575. Together, those three items total $3.26 million.

The town also faces wage pressures tied to a competitive regional labor market, along with ongoing costs to maintain equipment and safety gear for first responders.

Building maintenance is another factor. Major systems at facilities including the Mary Alley Community Center, Old Town House, Fire Headquarters and Department of Public Works are aging, and the operating budget has limited capacity for repairs.

On the regulatory side, the town faces compliance requirements under the MBTA Communities Act, along with increasing environmental, housing and accessibility requirements. Coastal infrastructure needs at locations including Hammond Park, Parker’s Boatyard, Cliff Street and Front Street also factor into long-term planning.

Kezer said that in prior years the town has been able to close budget gaps through a mix of one-time revenue sources and adjustments, but said those options are becoming more limited.

“In the past we’ve been able to make it work,” Kezer said.

School spending is projected to increase by $870,000 in fiscal 2027, according to the budget presentation.

Combined, town and school expenditures are projected to rise by about $6.6 million in fiscal 2027.

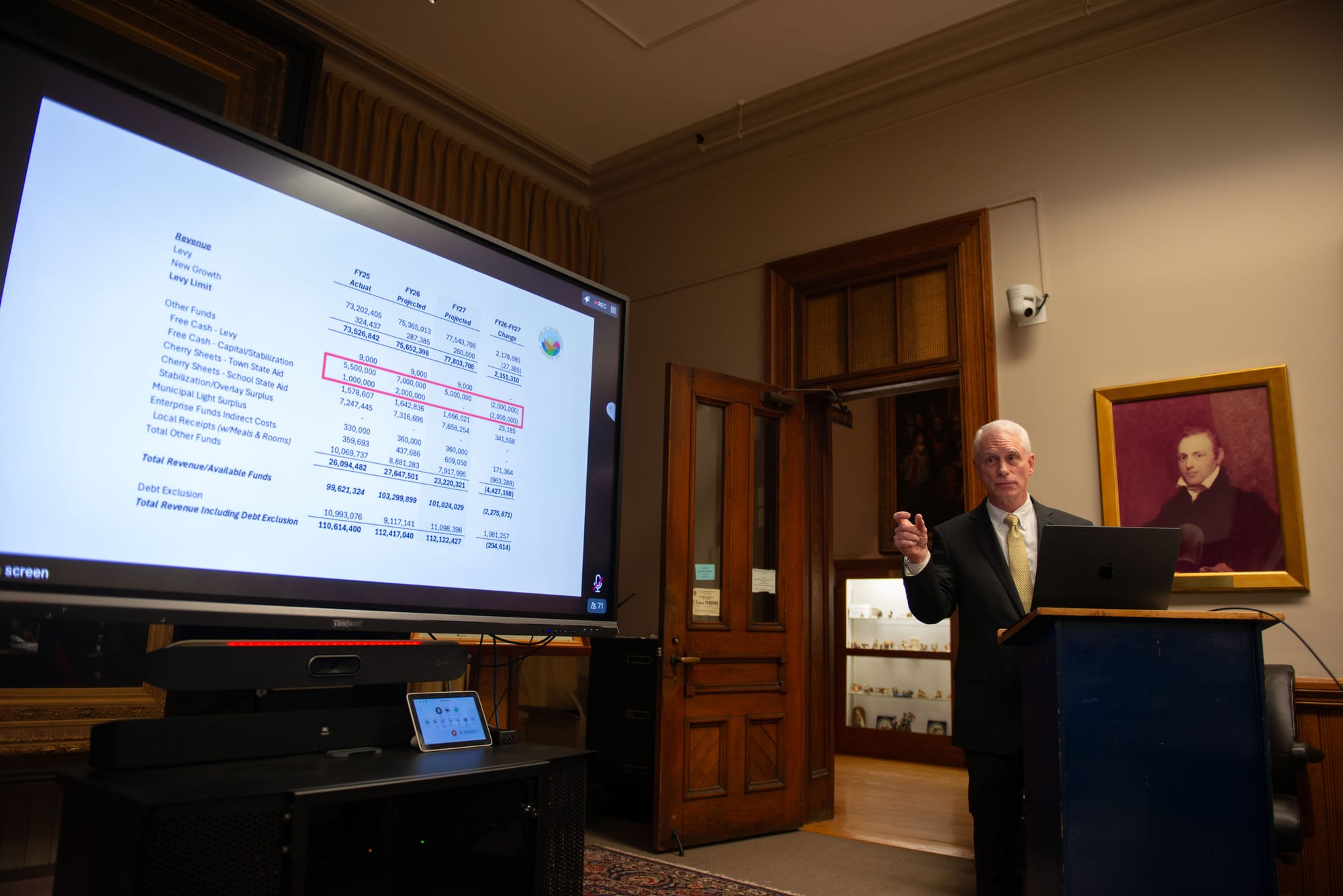

Declining revenue

Total available revenue is projected to fall by more than $2.2 million, with gains from the property tax levy offset by reduced use of reserve funds and declining local receipts.

The property tax levy is expected to increase by about $2.18 million under Proposition 2½ limits. State aid through Cherry Sheet payments is projected to rise by $364,743, and enterprise fund indirect costs will add another $171,364.

Those gains are offset by reductions elsewhere. The town is budgeting $2 million less from free cash to support the operating levy, dropping from $7 million to $5 million. Another $2 million previously allocated from free cash for capital and stabilization purposes is eliminated entirely. Local receipts from sources such as interest income, motor vehicle excise taxes and permits are projected to decline by $963,288.

Within local receipts, interest income is projected to fall by $784,677, from nearly $1.6 million to $800,000. Motor vehicle excise tax collections are expected to drop by $620,628, from $4.12 million to $3.5 million. Permit revenue is projected to decline by $359,881, from nearly $1.26 million to $900,000.

“Free cash is not free, and it’s not cash,” Kezer said. “Under best practices, we should be using zero dollars of free cash to balance the budget.”

Kezer said no decisions have been made about whether to pursue an override.

“This is about laying out the reality,” he said. “And then letting the community decide.“

Right now, 95 readers support The Marblehead Independent with recurring monthly or annual contributions, and we’re aiming to reach 100 by Jan. 31 so we can keep doing this work as fiscal 2027 decisions come into view. This reporting turns up records into context you can actually use before votes are cast. Click here to become an Independent member.