Table of Contents

Get our free local reporting delivered straight to your inbox. No noise, no spam — just clear, independent coverage of Marblehead. Sign up for our once-a-week newsletter.

The Select Board on Tuesday voted to set a single property tax rate of $8.59 per $1,000 of assessed value for fiscal 2026, keeping Marblehead’s long-standing practice of taxing homes and businesses at the same rate even as property values across town continue to climb.

Most property owners will still see slightly higher bills next year because their assessments are going up, even though the rate itself is dropping from the current $9.05 per $1,000.

According to a letter to the Select Board, the median single-family assessment is expected to climb from $1,125,000 in fiscal 2025 to $1,195,000 in fiscal 2026, an increase of 6.22 percent. At the new $8.59 rate, the owner of a home assessed at that median value would pay about $10,264 in property taxes next year, up from about $10,181 at this year’s $9.05 rate — an increase of $82.80, or roughly 0.81 percent.

Tuesday’s decision came at the board’s annual tax classification hearing, where members are required under state law to determine how the town’s overall tax levy will be divided among residential, commercial, industrial and personal property classes. The board again adopted a “residential factor” of 1.0, which keeps a uniform rate for all property types rather than shifting more of the burden onto Marblehead’s relatively small commercial base.

Rate down, bills up

The seemingly contradictory pattern — a lower rate but higher bills — stems from how Massachusetts property tax math works. State law limits how much the town can raise in total through property taxes each year — generally 2.5 percent plus new growth — so tax bills rise primarily because the levy increases, not simply because home values go up. But when individual assessments rise faster than the townwide average, as they did this year, a homeowner’s share of that levy can still increase even when the tax rate falls.

The town first determines how much money it can raise in taxes under Proposition 2½, then divides that levy by the total value of all taxable property to produce the rate.

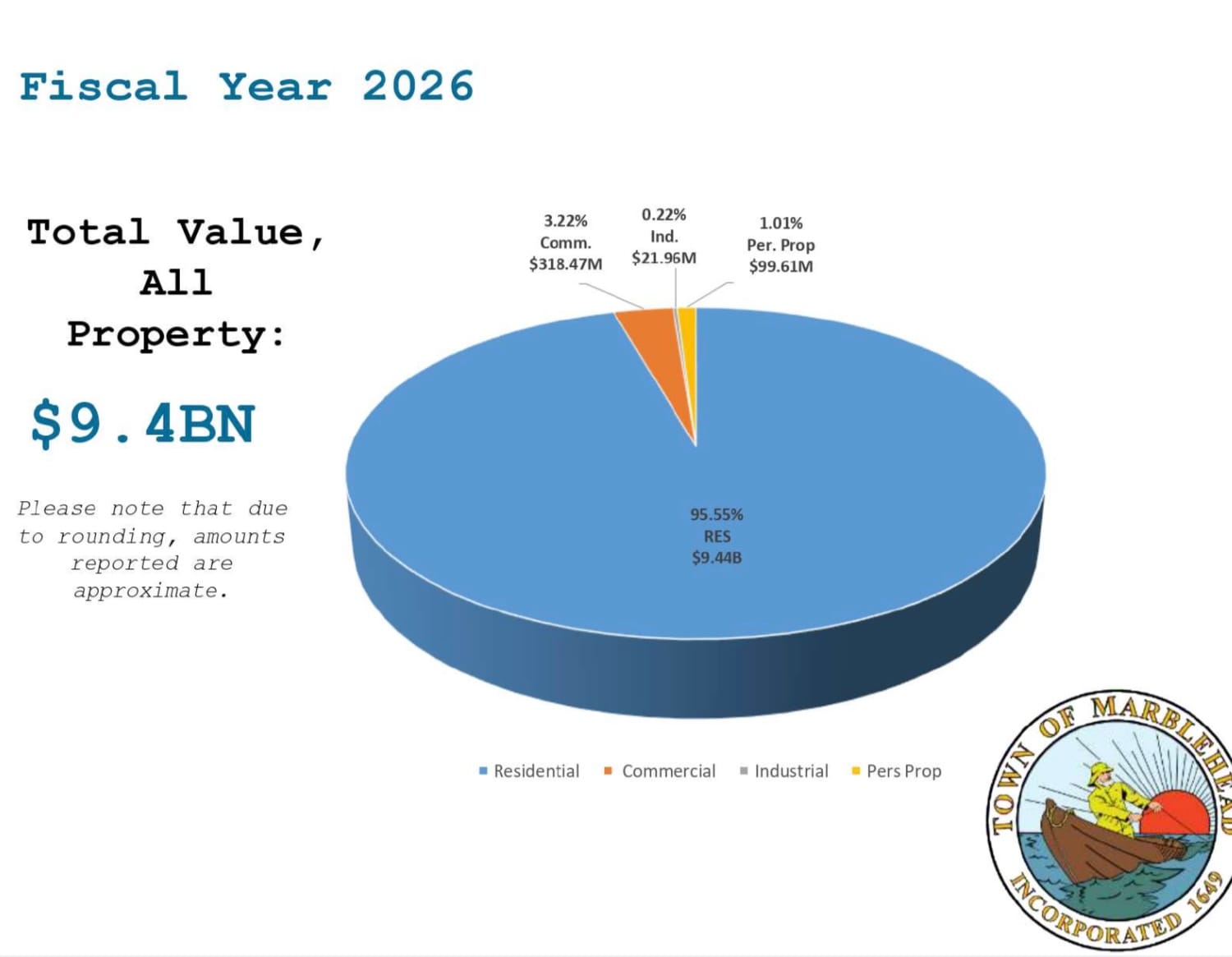

For fiscal 2026, the total assessed value of property in Marblehead rose about 6 percent, from roughly $9.32 billion to $9.89 billion, driven by continued home-price growth. Residential property makes up about 95 percent of that total, with commercial, industrial and personal property accounting for the rest.

Because Proposition 2½ caps how much the town’s total levy can grow — generally by 2.5 percent plus new growth and any voter-approved exclusions — the amount of tax money collected is rising more slowly than property values. Spreading that smaller increase over a larger tax base produces a lower rate per $1,000 of value, even as many individual bills edge up.

New growth cools from pandemic peak

Assessors also walked the board through a “New Growth Fiscal Year 2026” chart that illustrated how the value of new construction and business investment has cooled since a post-pandemic peak. The slide showed that total new growth is projected at about $287,000 for fiscal 2026, down from roughly $324,000 in fiscal 2025 and about $469,000 in fiscal 2024, with most of that growth coming from residential tear-downs and rebuilds rather than large commercial projects.

“Interesting new growth slide,” one board member remarked, noting “a pretty significant drop-off after all the COVID,” when residents were pouring money into additions, home offices and other renovations.

Assistant Town Assessor Todd Laramie said the softer numbers don’t mean activity has stopped, but reflect the lag between when work happens and when it shows up on the tax rolls. New growth is calculated off the prior calendar year, and assessments are fixed as of Jan. 1 — so several high-profile tear-downs and major projects around town will not be fully captured until fiscal 2027.

“There’s a ton of projects still going on … they’re just still at a stand[still] so we’ll pick them up next year,” Laramie said, pointing to the Gerry School redevelopment, the condo conversion at 89 Front St. and a wave of older homes being replaced with multimillion-dollar houses.

Select Board member Jim Zisson pressed on how quickly the jump from a “$700,000 property [to] $3 million” shows up in the numbers and argued that capturing the value of full rebuilds matters more than tracking “a $150,000 kitchen” renovation.

Town Administrator Thatcher Kezer added that the number of building permits has dropped from COVID-era highs, a trend he said is mirrored in other communities’ new-growth figures and could be compounded by higher construction costs as tariffs push up prices for lumber and steel.

Townwide tax impact

At the new rate, Marblehead will collect roughly $84.9 million in property taxes for fiscal 2026 — about $500,000 more than the $84.4 million generated in the current year. The modest increase reflects both levy limits and a small amount of new construction.

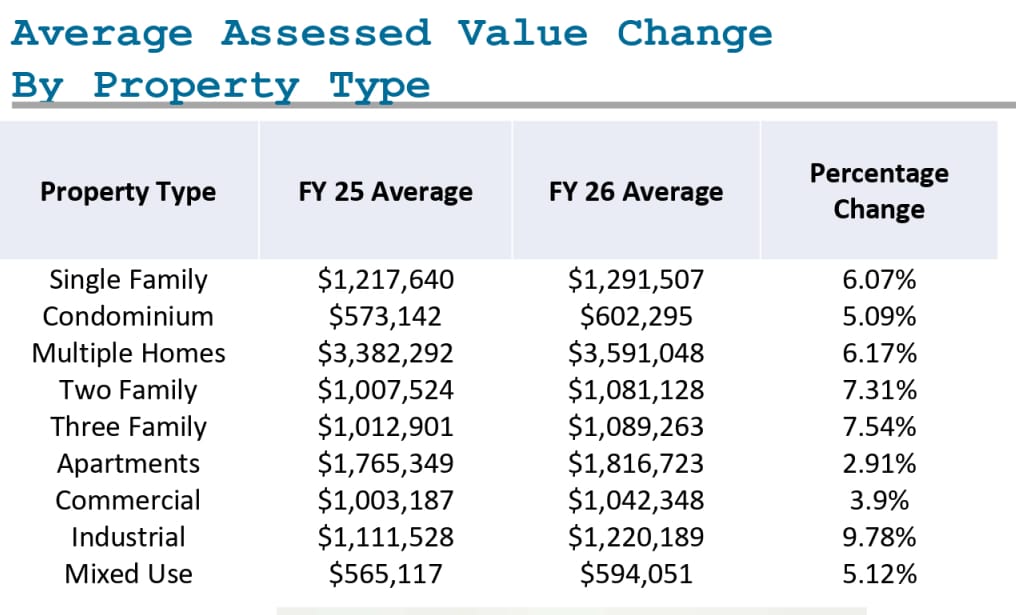

Other property types will see mixed effects based on median values. Condominium assessments rose from a median of $545,000 to $570,000, a 4.59 percent increase. Two-family homes climbed from $975,000 to $1,050,000, up 7.69 percent. Three-family properties increased from $995,000 to $1,075,000, an 8.04 percent rise.

Commercial properties saw median valuations increase from $837,500 to $880,000, up 5.07 percent. Industrial properties jumped from $1,037,500 to $1,162,500, a 12.05 percent increase.

If coverage like this helps you make sense of your tax bill, please consider becoming a member of The Marblehead Independent. It costs about $80,000 a year to run this newsroom, and your support keeps detailed, independent reporting on Marblehead’s finances free for everyone in town. We are also working to reach 100 members by the end of the year, and your monthly or annual contribution moves us one step closer. 🟦 Click here to become an Independent member.

Board declines tax-break tools

The board also declined to use any of the optional tax-break tools allowed under state law that can alter how the levy is shared among property classes. Those include a split commercial rate, a residential exemption for owner-occupied homes, a small commercial exemption for lower-value business parcels and an open-space discount.

With about 95 percent of the town’s tax base in the residential class, finance officials said a split rate would offer little relief to most homeowners while sharply increasing bills for local businesses. They noted that most Marblehead homes are already owner-occupied, meaning a residential exemption would provide limited benefit, and that a small commercial exemption would mainly aid landlords rather than the businesses renting space. No parcels in town currently qualify for an open-space discount.

As in past years, board members said those tax-break options would either offer too little benefit to most residents or shift too much of the burden onto Marblehead’s small business base.

Based on new FY26 assessments

The fiscal 2026 rate is based on new assessments reflecting property values as of Jan. 1, 2025, derived from 2024 sales data. The Massachusetts Department of Revenue has given preliminary certification to the valuations, which show a 6 percent townwide increase.

In October, the Board of Assessors published the full list of proposed valuations for public review at Abbot Hall, the Abbot Public Library, the Assessors Office and online — a transparency measure expanded after prior assessment errors prompted hundreds of abatement requests two years ago. Residents were encouraged to compare their new valuations with town averages and contact the Assessors Office with questions before bills are finalized.

With Tuesday’s vote to adopt the $8.59 single rate, the next step is state certification. Once approved by the Department of Revenue, the town can issue its third-quarter tax bills — the first to reflect the new fiscal 2026 assessments and rate.