Table of Contents

Get our free local reporting delivered straight to your inbox. No noise, no spam — just clear, independent coverage of Marblehead. Sign up for our once-a-week newsletter.

The Select Board spent more than an hour Wednesday night debating how — and when — to frame a potential Proposition 2½ override as the town confronts a projected $8.4 million fiscal 2027 shortfall, driven largely by health insurance costs that threaten to absorb nearly all new property tax revenue.

No one disputed the size of the gap. The split was over sequencing: produce a balanced budget first, then decide what voters might be asked to restore — or begin shaping a multi-year override strategy now, before reductions are finalized.

Town Administrator Thatcher Kezer said he and Chief Financial Officer Aleesha Benjamin have begun meeting department-by-department to reconcile spending requests with confirmed revenue. The immediate assignment, he said, is to present a balanced budget at the board’s Feb. 25 meeting based strictly on available revenue — not on any additional money from an override.

“You have to bring the overall bottom line down to a balanced budget,” Kezer said, warning that the reductions will be substantial. “This year, it’s not going to be nibbling around the edges. This is going to be some wholesale hits.”

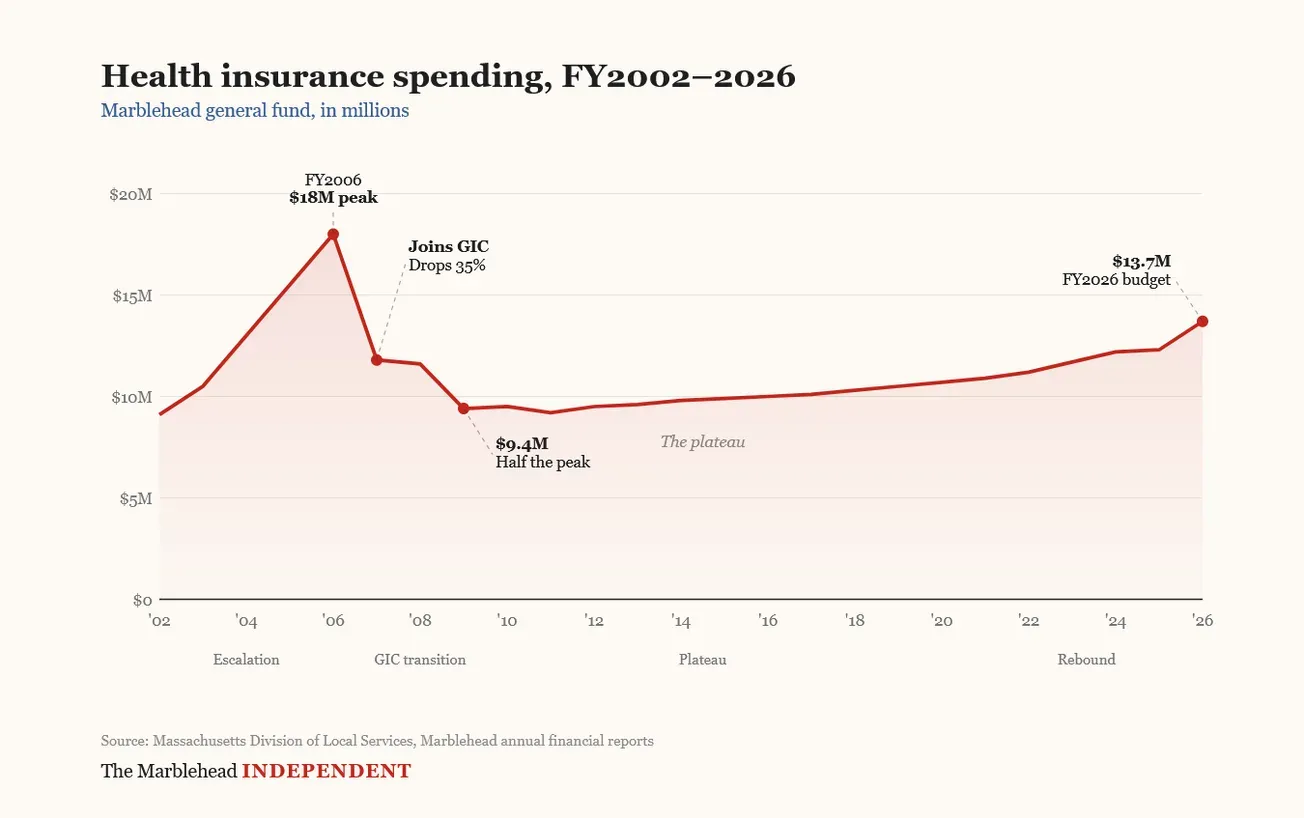

Health insurance consumes levy growth

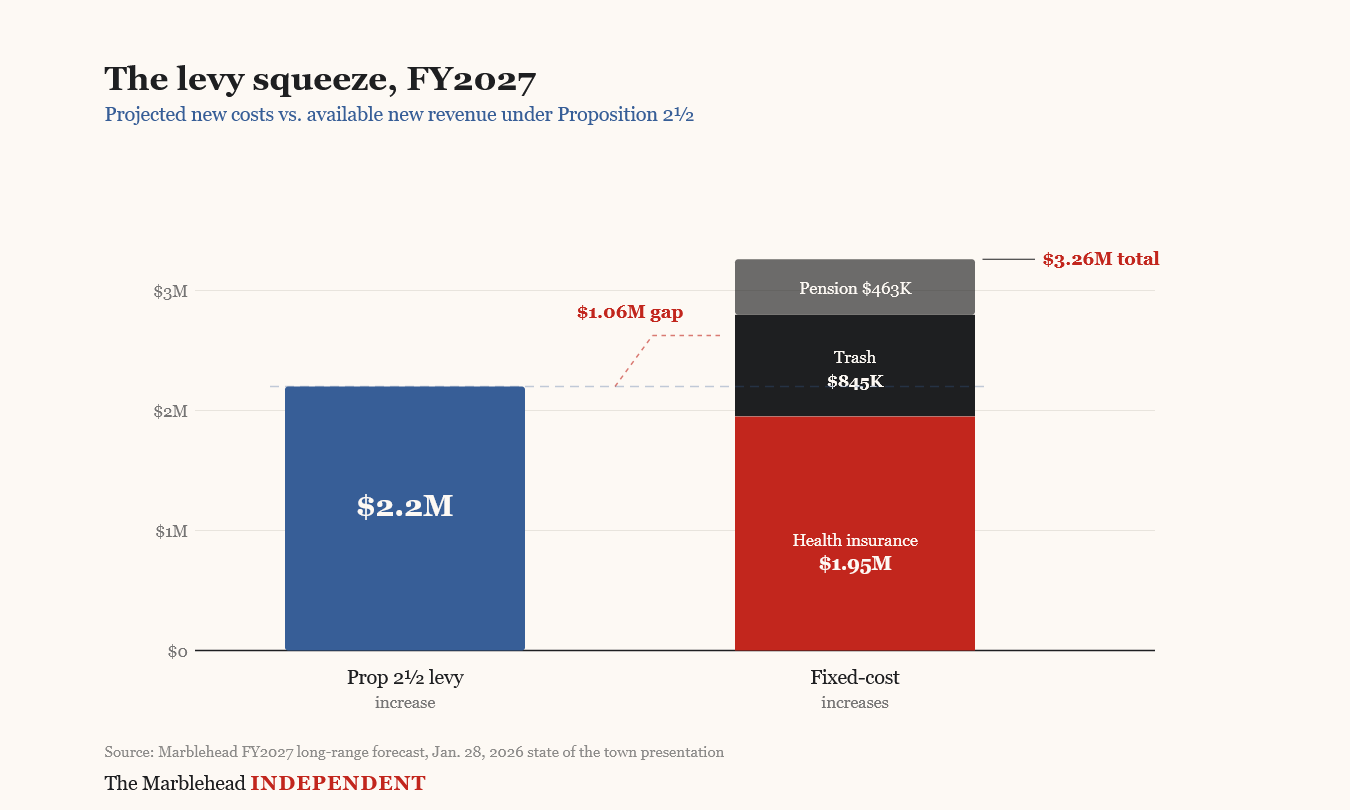

Under Proposition 2½, Marblehead’s property tax levy can grow by roughly $2.2 million per year. Current projections assume health insurance premiums will rise about 15 percent — the low end of estimates from the Group Insurance Commission (GIC) — which officials estimate would increase spending by roughly $1.9 million, but the GIC did project an average increase around 12.7 percent. At that level, health insurance alone would consume about 86 percent of the town’s new levy capacity. If the increase reaches the high end of projections, near 18 percent, the share would be even greater.

“The 15 percent increase scenario is 1.9 in change, just under $2 million,” Kezer said. “So nearly all of the Prop. 2½ increase is being taken by health insurance.”

He added: “And it’s not just Marblehead. It’s every municipality. It’s every business.”

Other fixed costs deepen the squeeze. A new trash collection contract adds roughly $800,000, and the pension contribution rises $462,735 on an actuarial schedule. Together with the projected insurance increase of $1,951,708 cited at the Jan. 28 State of the Town presentation, those three items total about $3.26 million in new fiscal 2027 costs — more than $1 million beyond expected levy growth.

Kezer noted the health insurance figure remains fluid: the GIC has not voted on final fiscal 2027 rates and is also weighing a plan redesign that would raise copays and deductibles for employees while reducing the premium cost borne by municipalities. The outcome depends on the commission’s mix of municipal and union representatives. April open enrollment could further change Marblehead’s blended increase because the town’s final cost depends on which plans employees choose.

“So if you just apply a 14 percent general number,” Kezer said, “this health plan which has 50 employees, and it may be going up 25 percent, and this health plan that has eight employees is only going up 6 percent, we’re getting hammered more than the 14 percent.”

Board splits on override direction

With the balanced budget still in progress, the board turned to whether staff should also prepare a multi-year override framework.

Select Board member Erin Noonan pressed for early direction, arguing the board — not the Finance Committee and not the town administrator — bears responsibility for setting override strategy.

“It’s our responsibility to give direction,” Noonan said. She said she does not see a scenario in which the town avoids placing some kind of override question before voters. For Feb. 25, she asked for at least two options: a multi-year projection showing what it would take to preserve current service levels, and a second scenario reflecting targeted investments to restore positions and capacity reduced over the past five years.

Noonan argued that “level funded” budgets in an inflationary environment amount to reductions and cited specific staffing losses.

”In the last five years, we’ve level-funded to defunding one full-time police officer,” Noonan said. “We’ve defunded several firefighter positions. Our Department of Public Works has lost three full-time — we’ve had a heavy equipment operator, we’ve lost a working foreman and a general laborer.”

Chair Dan Fox said he supports the concept of a multi-year approach, arguing the town should avoid returning to voters annually to close recurring gaps.

“We can’t plug the gap for one year, because we’re back” in the same position, Fox said. He suggested the board could offer voters a clear accounting of what each year’s funds would support and could publicly commit not to levy the full override amount in year one if conditions allow.

Select Board member Moses Grader warned against putting the full projected multi-year deficit on a single ballot question. The town’s long-range forecast projects the structural gap widening to $11 million in fiscal 2028 and $15 million in fiscal 2029. Grader said presenting a cumulative figure would be politically unworkable.

“You really want to go to the town and ask the town for $15 million?” Grader said. He supported projecting future costs but distinguished that from asking voters to fund them all at once. The override, he argued, should address the immediate gap while signaling that departments will continue making operational adjustments to bring costs down over time.

Select Board member Alexa Singer and member Jim Zisson said they were not ready to commit to an override structure without first reviewing the balanced budget and updated figures on both the town and school sides.

“I think it’s premature to be talking any number,” Singer said. “The work is still in progress. We don’t know what the data is.”

Singer said she wants department heads, while preparing balanced-budget submissions, to document what has been cut or deferred in recent years, what capital needs are approaching, and what efficiencies have been found. Without that information, she said, discussions about an override are speculative.

Zisson said the School Committee signaled at a recent meeting that it may not need an override on the school side — a remark he attributed to School Committee member Al Williams — and said the landscape could shift further once both budgets are finalized.

No vote was taken on override strategy.

Balanced budget comes first

Kezer reiterated that the administration’s immediate assignment is to deliver a balanced budget on Feb. 25 based on confirmed revenue. That will require prioritizing across departments. Benjamin has directed departments to submit level-funded proposals adjusted only for contractual obligations, and Kezer said the resulting reductions will be significant.

He described a triage approach: some departments may receive needed investment while others are told to wait for a future fiscal year.

“What are the departments that are in most dire need of investment,” Kezer said, “as compared to other departments, and picking and choosing: this year we’re going to have to take care of this department, and the rest of the departments, you just kind of have to wait for another fiscal year.”

Public engagement sessions planned

Board members also discussed improving public understanding of municipal operations before Town Meeting. Several supported holding engagement sessions in March — described as informational forums rather than budget hearings — where department heads would explain staffing, service delivery, and operational constraints.

Noonan said the sessions could help residents better understand staffing levels and priorities. Singer recalled similar sessions held under a previous town administrator and said they helped residents understand the rationale behind decisions they might otherwise question.

Zisson urged the board to solicit cost-saving and revenue ideas from residents, consider putting purchased services out to competitive bid through the town’s new procurement director, and demonstrate that officials are pursuing efficiencies. “We have to show the citizens that we’re walking under every couch cushion,” he said.

Grader renewed his push for a formal performance-based budget document — a GFOA-style format combining strategy, metrics, and financials — arguing it would address persistent complaints about lack of information.

Political backdrop

The override debate unfolds against a long voting history under Proposition 2½. A Marblehead Independent analysis of 114 ballot questions since 1982 found that debt exclusions for capital projects passed 81% of the time, while operating overrides failed 86% of the time. The town has not approved a general operating budget override since June 15, 2005, when $2.73 million was permanently added to the annual tax base.

For now, the board’s focus remains on producing a balanced budget. Once those reductions are visible, members will decide whether to ask voters for additional revenue — and how to structure the question.