Table of Contents

Get our free local reporting delivered straight to your inbox. No noise, no spam — just clear, independent coverage of Marblehead. Sign up for our once-a-week newsletter.

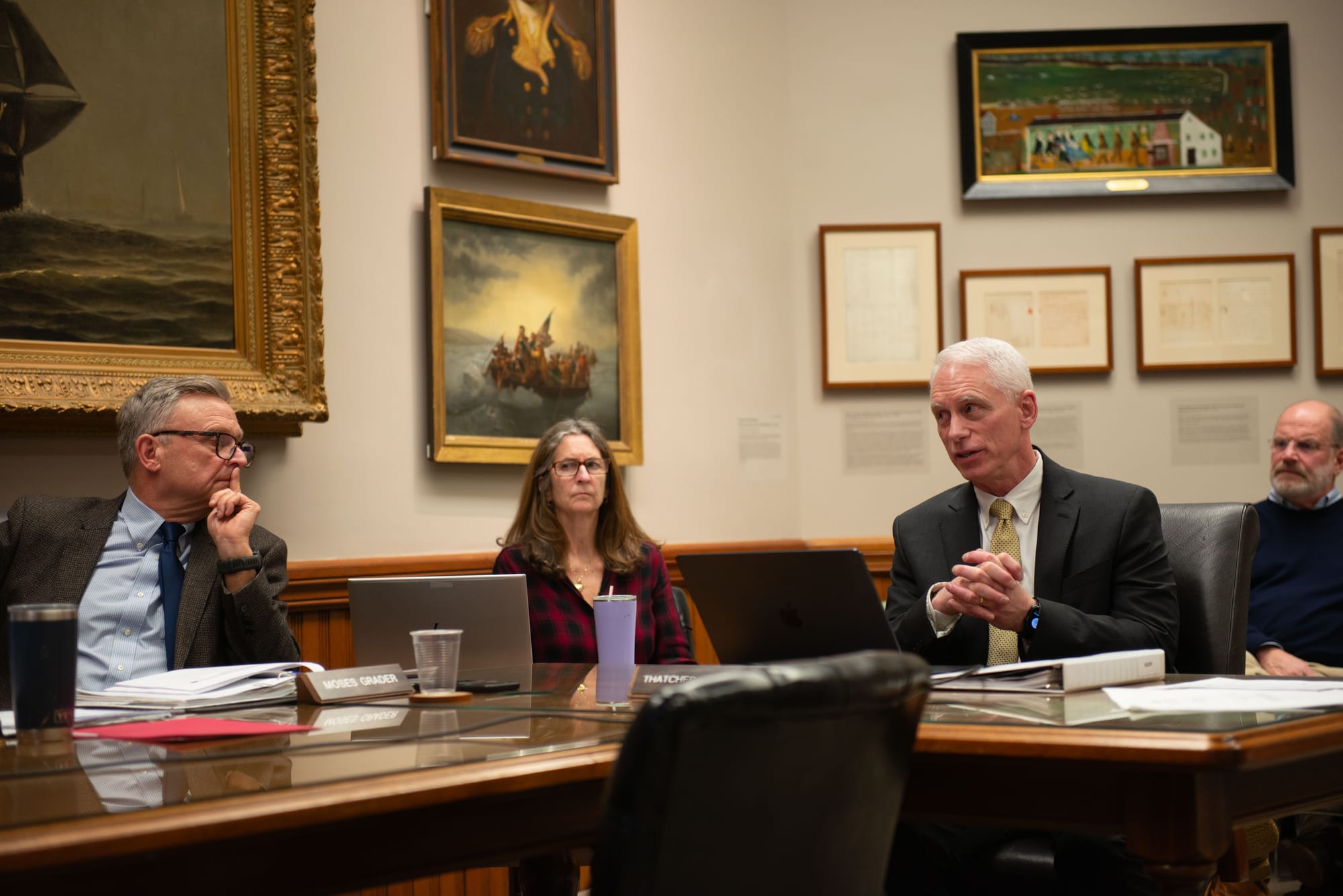

Following Town Administrator Thatcher Kezer’s State of the Town presentation Wednesday night, Select Board members and residents engaged in an extended exchange that surfaced unresolved questions about the assumptions underlying the town’s projected $8.47 million budget gap and the choices ahead.

The discussion, which lasted more than an hour after Kezer concluded his remarks, revealed broad agreement on the seriousness of the fiscal outlook but persistent uncertainty about how the town will structure its response. No decisions were made about whether to pursue a Proposition 2½ override, how large any such measure might be or which services would face cuts under a no-new-revenue scenario.

The projections mark a departure from prior years. Town officials have consistently delivered balanced budgets that maintained service levels without dramatic cuts, even as fiscal pressures mounted. This year represents a convergence of factors that make balancing the budget without significant trade-offs far more difficult.

The $8.47 million gap represents the difference between projected revenues of approximately $92 million and requested expenditures of roughly $100 million, according to figures presented Wednesday. The town’s total municipal budget, including debt exclusions, is approximately $120 million.

Throughout the Wednesday discussion, Finance Director Aleesha Nunley Benjamin provided detailed responses to technical questions, offering granular explanations of pension funding schedules, interest income trends and the methodology behind revenue projections. She noted that the town is not fully funded on its pension obligations and is working toward a state-mandated deadline, clarifying apparent confusion about the funding status.

“We are not fully funded,” Benjamin said. “There’s a state debt mandated deadline for many municipals across the state.”

She offered to provide additional data to any board member or resident seeking more detail, and noted that she had already reviewed interest income projections with the Finance Committee chair.

Select Board members seek process clarity, structural answers

Select Board Chair Dan Fox opened the discussion by asking Kezer to clarify the timeline for refining the projections, emphasizing that the figures presented were preliminary. Fox noted the board hoped revenues could be increased and expenses tightened as actual costs become clearer. He later acknowledged the scope of work ahead.

“I think we have a lot of work to do to explain it,” Fox said after residents raised detailed questions about specific line items.

Select Board Member Moses Grader framed the challenge in structural terms, noting that personnel costs drive the majority of town spending.

“Fundamentally, 80 percent of our budget across the town is head count,” Grader said. “So we fundamentally have a head count issue.”

Grader said scrutiny of staffing levels across municipal departments would be central to the Finance Committee’s review, describing it as the only realistic lever for closing the gap without new revenue.

Select Board Member Alexa Singer focused on whether the proposed budget aligned with the town’s adopted financial policies. She questioned projected declines in new growth revenue and sought clarification on how free cash was being allocated, noting that the projections appeared to draw down nearly all available reserves.

Singer also raised concerns about deferred capital spending and building maintenance, pointing to the long-term cost of postponing repairs.

“Every time you’re at that situation, and then you’re pushing it off, whether it’s a roof, whether it’s this — it’s just the cost going exponentially,” Singer said.

She asked for more granular breakdowns of how capital and operating funds had been allocated in prior years and urged clearer communication about how those decisions align with policy goals. Singer also acknowledged the value of the December presentation by Benjamin and encouraged residents to review that session for additional context.

Select Board Member Erin Noonan, participating remotely, called for adding budget discussions to every future meeting, citing both the magnitude of the projected gap and the volume of public questions.

“I’d like to bring an agenda item for every meeting,” Noonan said. “Because I think you can see, we’ve had a lot of questions, but I think the public’s going to have a lot of questions.”

Noonan said the approach would help ensure transparency and give residents an opportunity to engage before decisions are finalized.

Select Board Member Jim Zisson asked Kezer to provide a public timeline of the budget process and emphasized the long-term nature of the town’s fiscal challenges. He noted that Marblehead’s stabilization fund remains well below its $5 million target and that the structural gap would not be resolved by a single-year fix.

“It doesn’t seem to me that this situation, which presents itself as a structural situation, would be resolved in a year,” Zisson said.

Kezer noted that much of the fiscal pressure stems from factors beyond the town’s control. The trash collection contract is expiring after 10 years, producing cost increases that reflect a decade of deferred inflation. Health insurance premiums are rising 15 to 18 percent statewide through the Group Insurance Commission. And pension contributions are set by actuarial schedules, not local discretion.

“This is the perfect storm hitting us,” Kezer said during his presentation.

He compared the current situation to the 2007-2009 recession, when he served as a municipal administrator elsewhere in Massachusetts, and noted that officials across the state are facing similar pressures.

“All the managers and mayors that I spoke to are all having the same conversation,” Kezer said.

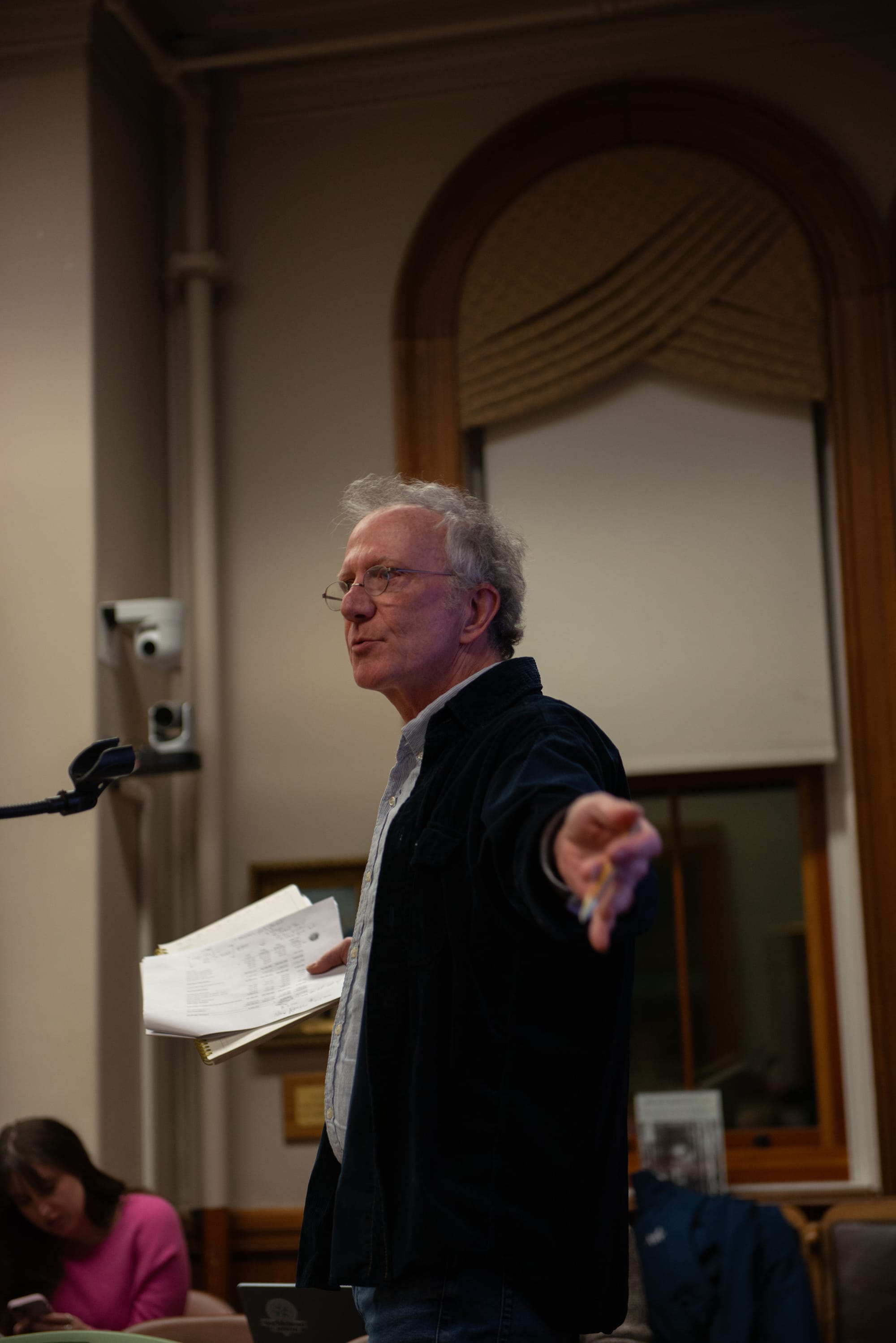

Public comment raises questions about override strategy, accountability

During public comment, former Finance Committee member Sarah Fox offered a detailed explanation of how a Proposition 2½ override would function, challenging what she described as “inside baseball” terminology that may obscure the choices facing voters.

“Just to be clear, a proposition two and a half override is a forever override,” Fox said. She explained that the central question is whether to pursue a larger override now to build levy capacity that grows annually at 2.5 percent or to plan for smaller, consecutive overrides in successive years.

“The question on the table is a supersized override that will carry us a few more years or consecutive Prop. 2 1/2,” Fox said.

She urged officials to communicate those options more directly and credited the work involved in assembling the projections while noting the town has approximately 13 weeks before Town Meeting.

If officials do pursue an override, history suggests a difficult path. A Marblehead Independent analysis of the town’s Proposition 2½ votes since 1982 found that operating overrides — which permanently increase the tax levy for routine services — have passed only three times and failed 18 times. The last successful operating override was approved on June 15, 2005, more than 20 years ago. By contrast, debt exclusions for capital projects have passed 68 times and failed 16 times over the same period.

Voters have shown consistent willingness to fund things they can see and touch — approving three new school buildings, fire apparatus, seawall reconstruction and historic building restorations through temporary tax increases — while rejecting permanent budget growth for routine services. Operating override requests failed in 2022 and 2023, even as costs rose faster than the 2.5 percent annual levy growth allowed under Proposition 2½.

Resident Jim Regis pressed officials on cost control and forecasting, questioning why the projected budget gap had grown to more than $8 million. He raised concerns about interest income projections, property assessments on renovated homes and capital spending transparency.

“If this cliff was coming, what were we doing to prepare for it?” Regis asked.

Benjamin responded with specific figures, noting that interest income through the current fiscal year was running just over $500,000 and explaining the mechanics of how borrowing rates constrain investment returns on bonded funds.

Resident Albert Jordan expressed skepticism about pursuing a large override, citing affordability concerns for elderly residents living on fixed incomes. He questioned spending practices across departments and urged the Finance Committee to examine costs more closely.

“I don’t want to have no super override,” Jordan said. “I’ll bite the apple a little bit within reason.”

When asked whether the town would implement a hiring freeze, Kezer said officials had been scrutinizing vacancies but did not announce a formal policy.

The meeting concluded without action. Officials said they would continue refining projections and engaging with department heads over the coming weeks, with Finance Committee hearings and a public budget process to follow. Town Meeting is scheduled for May 4, and any override approved there would proceed to a ballot question in June.