Table of Contents

Finance Director Aleesha Nunley-Benjamin delivered a blunt assessment to the Finance Committee on Nov. 3: the town’s budget model is “mathematically unsustainable,” and without structural change, Marblehead will struggle to maintain current services.

Speaking at the committee’s monthly meeting, Benjamin presented her fiscal year 2027 revenue forecast — projecting total revenues of $109.24 million, down $514,000 from the current year’s budget — and explained that the decline reflects deeper constraints than any single line item.

“Inflation hasn’t been under 3% since 2020,” Benjamin said. “We’re stuck at two and a half.”

She was referring to Proposition 2½, the state law that limits annual property tax growth to 2.5% plus new construction value. For Marblehead, that translates to roughly $2.2 million in new property tax revenue each year. But the gap between that growth and actual cost increases has widened.

“When you’re at two and a half and inflation is at three, you’re losing ground,” Benjamin said.

The numbers bear that out. Property taxes will rise to $77.86 million in FY27, an increase of $2.19 million over the prior year. But that gain is more than offset by a $2 million reduction in free cash use — from $7 million in FY26 to a projected $5 million in FY27 — and declining interest income as federal ARPA funds are depleted.

Free cash, which represents unspent funds from prior years, has been used increasingly to balance operating budgets. Benjamin warned that practice is unsustainable.

“Free cash is one-time revenue,” she said. “It should fund one-time capital needs, not recurring expenses.”

Major cost pressures accelerate

The result is a shrinking revenue base at a time when major cost drivers are accelerating. The town’s new trash contract alone is expected to add $800,000 to $1 million in FY27. Health insurance costs are projected to rise 14%, adding roughly $1.5 million to $1.6 million. Personnel costs, which account for 80% of the operating budget, will grow by 3% under most union contracts.

State aid, meanwhile, is expected to increase by just 1% — about $90,000 — far short of offsetting those pressures.

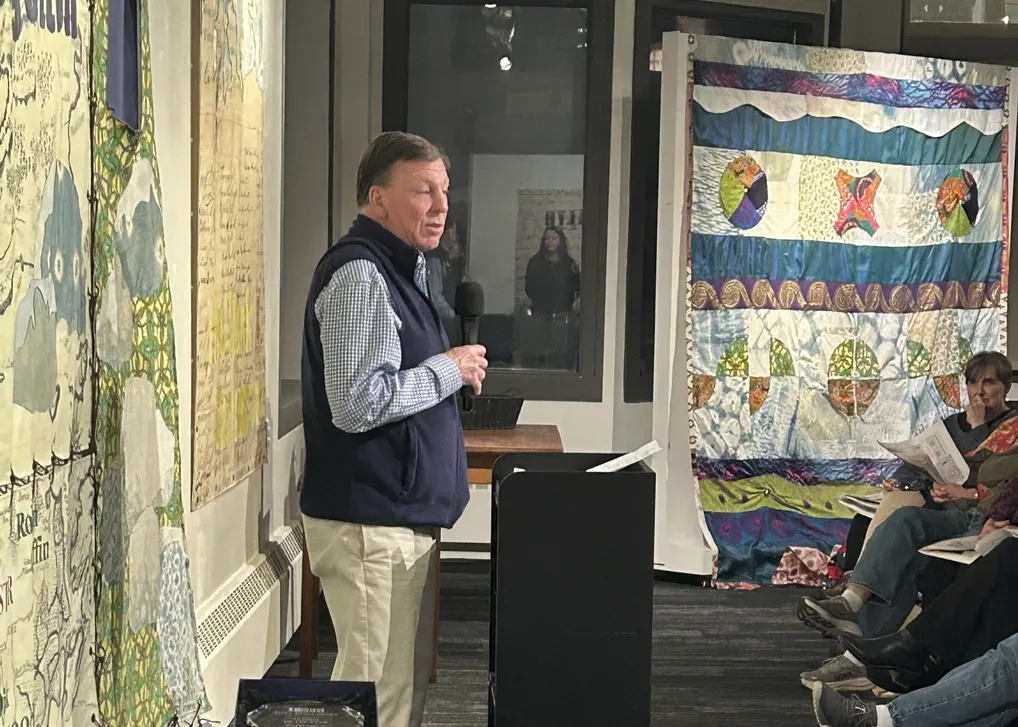

Finance Committee Chair Alec Goolsby emphasized that Benjamin’s forecast represents the beginning of the budget process, not a final determination.

“This is the first step,” Goolsby said. “Our job is to present the facts.”

He walked the committee through a detailed spreadsheet comparing five years of actual revenue data with the FY26 budget and FY27 projections. The exercise showed how seemingly modest annual shifts — a $100,000 decline in motor vehicle excise taxes here, a $200,000 drop in investment earnings there — compound into structural deficits.

Goolsby cautioned against overestimating revenues in budget planning, noting that conservative estimates are essential to financial stability. He also stressed that the committee’s role is to define the fiscal reality clearly, not to advocate for or against policy solutions like a general override.

“We’re here to educate,” he said. “The Select Board will have to decide what path they want to take.”

Financial systems modernize amid uncertainty

Vice Chair Pat Franklin supported Benjamin’s conservative assumptions but asked whether the certified free cash figure might come in higher than projected.

“Hopefully, yes,” Benjamin replied. “But not by much.”

She explained that the town has made significant progress modernizing its financial management systems. The recent transition to Munis software has streamlined cash reconciliation, and external consultants have been brought in to clear a backlog of unreconciled accounts. That work should allow free cash to be certified earlier in the budget cycle, reducing uncertainty.

Still, Benjamin said, the underlying fiscal pressures remain.

Finance Committee member Tim Shotmeyer asked about the broader implications of the numbers Benjamin presented, particularly for departments with limited flexibility.

Benjamin confirmed that many departments face contractual obligations that leave little room for reductions without cutting positions or services. She noted that Massachusetts health insurance costs now rise faster than the national average, driven by high provider costs and limited competition.

The discussion also touched on the consequences of Marblehead’s rejection of the MBTA Communities Act, which requires zoning for multifamily housing near transit. Benjamin explained that noncompliance has cost the town access to competitive state grants, compounding revenue constraints.

“We’ve lost millions of dollars in discretionary grants,” Finance Committee Vice Chair Molly Teets said. “People don’t always connect that to the three-A vote, but it’s real.”

The committee agreed to request level-funded department budgets adjusted only for contractual obligations, a policy that will force difficult conversations about service reductions if new revenue isn’t identified.

Goolsby noted that departments with small staff counts have little flexibility to absorb cuts without eliminating positions or services entirely.

“A department with three employees can’t stay level-funded if their contracts go up 3%,” he said. “That’s the reality.”

Committee focuses on transparency, education

Benjamin’s presentation reflected a broader trend across Massachusetts towns, where expenses tied to labor, insurance and infrastructure are rising faster than capped property tax revenues. The Massachusetts Municipal Association recently released a report documenting similar fiscal pressures statewide.

Finance Committee members said they plan to hold educational sessions leading up to the State of the Town address, scheduled for late January or early February, to present verified data to residents.

Teets, who attended a recent Association of Town Finance Committees conference with Franklin, said failed override attempts in other towns often stemmed from poor communication.

“The message has to be clear,” she said. “People need to understand what they’re voting on and what happens if it doesn’t pass.”

Goolsby emphasized that transparency would be critical.

“This is not panic time,” he said. “This is planning time.”

Marblehead has not passed a general operating override since 2005. The town maintains a AAA bond rating, reflecting strong financial management and responsible use of debt exclusions for capital projects. But Benjamin’s message was clear: the operational foundation is weakening.

“We can’t keep doing this,” she said. “The math doesn’t work.”

Correction: An earlier version of a story about the Marblehead Finance Committee’s recent meeting misstated a title and attendee information. Molly Teets is vice chair of the Finance Committee, not simply a member, and she attended the FinCom Association Conference with Pat Franklin, not Eric Knight.