Table of Contents

Get the latest from The Marblehead Independent delivered straight to your inbox.

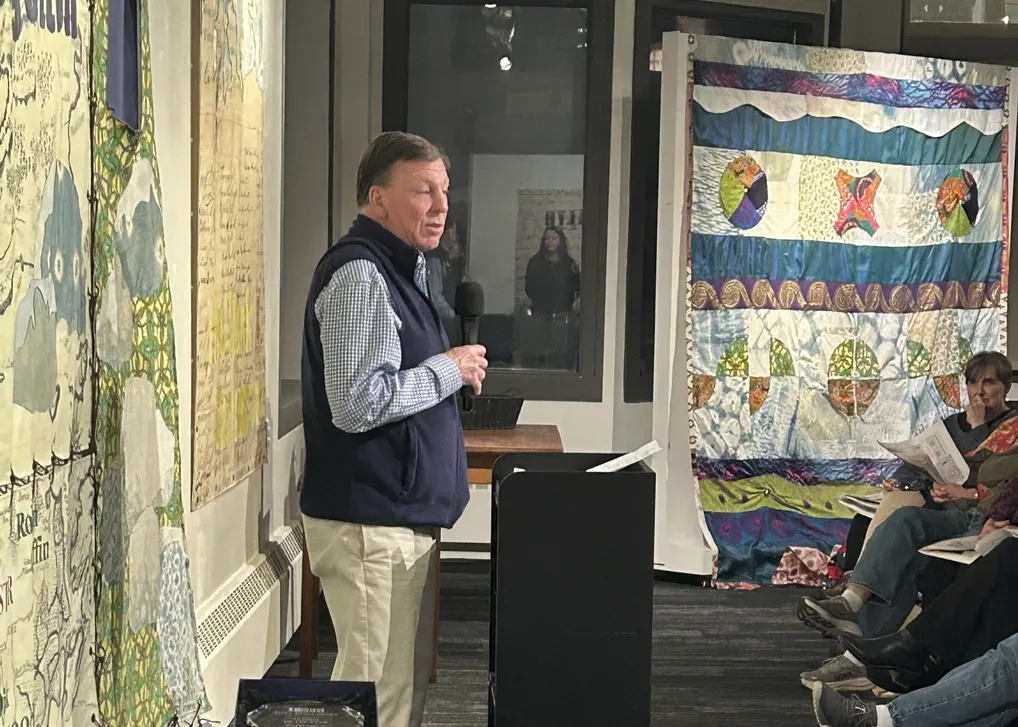

Marblehead’s fiscal 2027 revenue is projected to decline by roughly $514,000 as rising costs outpace limited property tax growth, Finance Director Aleesha Benjamin warned in a financial forecast presentation to the Select Board on Wednesday.

Property taxes and debt exclusions account for approximately 80% of town revenue, with fiscal 2027 (FY27) property taxes projected at $77.9 million and debt exclusions at $9.1 million, according to Benjamin’s slides. The town’s 2.5% cap on property tax increases under Proposition 2½ equates to approximately $2.2 million year over year, while inflation continues at 3%.

“For fiscal year 2027, state aid is expected to increase by 1%, not keeping pace with inflation or increasing budget costs,” Benjamin said during the presentation.

The revenue forecast represents the first step in the general fund budget process, according to Finance Committee member Alec Goolsby, who joined Benjamin for the presentation. Goolsby emphasized the preliminary nature of the projections.

“Before I start talking about the revenue forecast, I just want to reiterate this is the first step to the general fund budget,” Goolsby said. “Every year we haven’t detailed out the expenses.”

State aid is expected to reach $9 million in FY27, with modest increases across categories. Chapter 70 education funding rose $382,800 to $7 million, while charter tuition reimbursement decreased $67,617. Unrestricted general government aid for the town increased $15,424 to $1.4 million.

Local receipts are projected at $8.1 million for FY27, down from $10.1 million in FY25. Motor vehicle excise taxes are expected to decline to $3.6 million from $4.1 million in FY25. Benjamin noted the complexity of projecting these volatile revenue sources.

“I actually have to do economic research when we’re doing this, in addition to cash trend analysis to figure out what we should project,” Benjamin said.

Town Administrator Thatcher Kezer explained the volatility of motor vehicle excise revenue.

“Vehicle excise tax is very susceptible to the economy,” Kezer said. “So we get maximum revenues when people are buying new, brand new cars. So the first year value assessment is the highest, right?”

Interest income continues to fall as rates dropped from 5% to 3.75%, with investment earnings projected at $800,000 compared to $2.4 million in FY24. Goolsby noted the dramatic shift in recent years.

The meals and rooms excise tax generated $700,000 in its first full year of implementation but has been budgeted conservatively at $600,000 for both FY26 and FY27.

“Meals is brand new excise,” Benjamin said. “So the first year I projected $200,000 to be conservative. We actually brought in $277,000 and $423,000, so I brought that up to $200,000, still conservative, but within what we actually received.”

The Marblehead Municipal Light Department surplus remains relatively flat at $360,000 for FY26, marking the first adjustment to the surplus in many years. Enterprise indirect costs are rising from $330,000 to $360,000.

Free cash budgeted for operations dropped from $7 million in FY26 to $5 million in FY27, a reduction Benjamin characterized as unsustainable.

“Using it to balance the budget, which is unstable, and the state has said to everybody, do not use free cash to balance budget,” Benjamin said. “Our next step is a general override. We haven’t had one since 2005.”

Major cost pressures include a trash contract increase of $800,000 to $1 million in FY27, health insurance rising 14% and personnel costs consuming 80% of the budget with contracts increasing 3%. Benjamin said inflation at 3% means everything costs more.

The health insurance increase represents a significant departure from recent trends, according to Select Board member Jim Zisson.

“In recent years, they’ve been more like 6%, right?” Zisson said during the discussion.

Benjamin explained the health insurance challenge facing the town and why Massachusetts rates exceed national averages.

“Massachusetts state health insurance is beyond the national average,” she said. “So no longer can I look at the national average. I have to actually participate in these different seminars and listen to the insurance companies in the state, because our rates are actually driving so much faster than the nation of all states across the country.”

Zisson calculated the health insurance increase represents approximately $1.5 million to $1.6 million more than FY26.

Federal ARPA relief funds supporting capital projects will be fully spent by the end of 2026. Grant reductions include fewer federal grants and Massachusetts Bay Transportation Authority 3A noncompliance penalties limiting access to state funding.

Benjamin emphasized the impact of debt exclusions on the town’s financial standing while warning that operational costs remain underfunded.

“Exclusions have maintained the town’s AAA bond rating,” she said. “So by passing those debt exclusions it shows the bonding agencies that they’re very serious about covering capital costs. But we’re not funding our operations and maintenance, and that’s a serious issue.”

Expenses have grown faster than revenues since 2020, according to Benjamin’s presentation. The Finance Committee plans to extend the revenue projections another two years and analyze the top five expense categories for a presentation in early December.

More information is expected at the State of the Town address in January or February 2026.