Table of Contents

The town’s fiscal 2024 audit showed strong financial performance with revenues beating forecasts by $2 million and expenditures $5.8 million under budget, but auditors identified significant weaknesses in cash management and federal compliance that delayed the report’s completion.

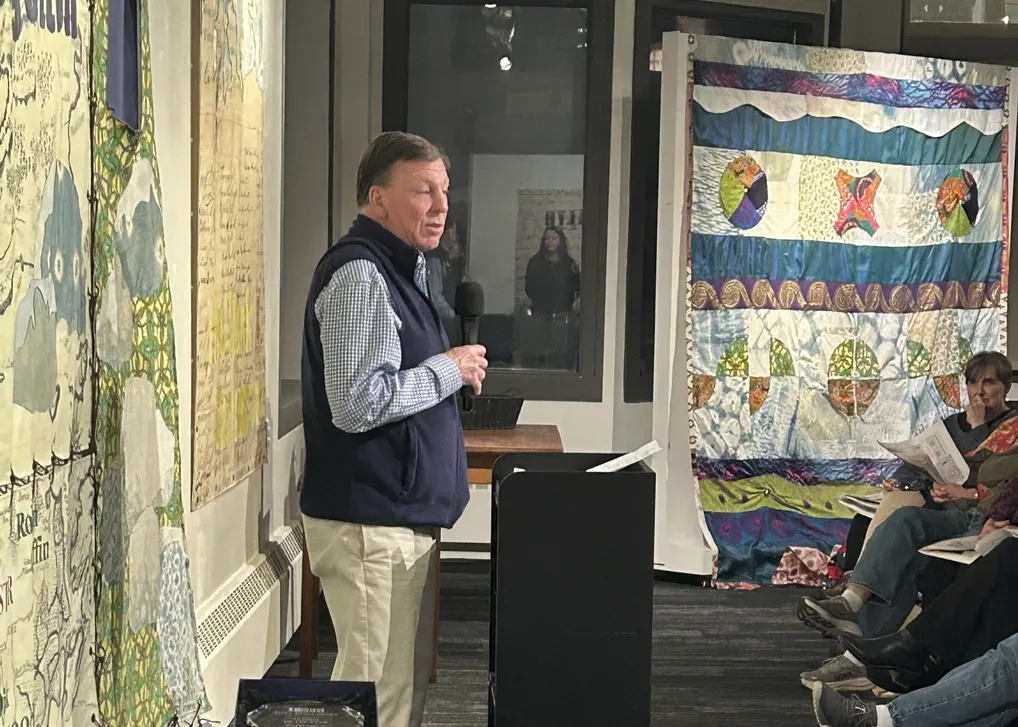

Roselli, Clark & Associates delivered the audit exit conference to the Select Board Sept. 24, issuing a clean opinion on the town’s financial statements while flagging material deficiencies that required correction.

The audit revealed reserve balances between $18 million and $21 million over the past decade, maintaining the town’s AAA bond rating. That rating places Marblehead among the top 10% of Massachusetts communities and ensures access to favorable borrowing rates for future capital projects.

Investment income reached $3.2 million, double the previous year, as the town capitalized on higher interest rates. Treasurer Cammy Inerella locked funds into certificates of deposit at 5% before rates dropped, according to Fiance Director Aleesha Benjamin.

Long-term liabilities showed modest improvement. The pension system’s $54 million unfunded liability decreased $4.3 million and stands nearly 70% funded. The Other Post-Employment Benefits liability for retiree health care totaled $151.6 million, down $4 million due to investment gains. Plan assets grew to $4.5 million from $3.9 million.

Partner Paul Gargano identified material weaknesses in the cash and bank reconciliation process that delayed financial statements and the town’s free cash certification. The treasurer’s office had been carrying closed bank accounts on reconciliations, improperly valuing investments and failing to maintain accurate outstanding check lists.

“A lot of this was due to turnover,” Gargano said, noting the current treasurer inherited inadequate processes. “I think it’s also important for them to develop systems that Cami and the staff can follow, and to train everyone on those systems so they can leave and she can just keep the ball rolling.”

The town has hired consultants and is implementing the Munis cash management system to replace the current patchwork of QuickBooks, Excel spreadsheets and other software.

Federal compliance issues included improper reporting of obligations under coronavirus relief funds and failure to verify whether vendors receiving more than $25,000 had been suspended or debarred from federal programs — a requirement for all federal grants.

Town Administrator Thatcher Kezer said structural changes have addressed many problems, including hiring a full-time chief procurement officer and grant coordinator.

“The first big step we took fixed a lot of this stuff, is hiring a very competent and hardworking CFO who could lead the rest of us through the path of getting beyond these things,” Kezer said.

Select Board member Jim Zisson asked whether the material weaknesses would affect bond ratings. Gargano said S&P now expects financial statements within one year or may adjust credit ratings.

The audit showed financial trends remained strong, with metrics exceeding the 15% reserve ratio that qualifies for top-tier ratings. Wealth factors and real estate values also support the AAA designation.

Partner Tony Roselli warned about growing OPEB liabilities, noting the town’s 3% to 4% funding level falls below recommended levels. Benjamin said she plans to increase OPEB contributions in future budgets