Table of Contents

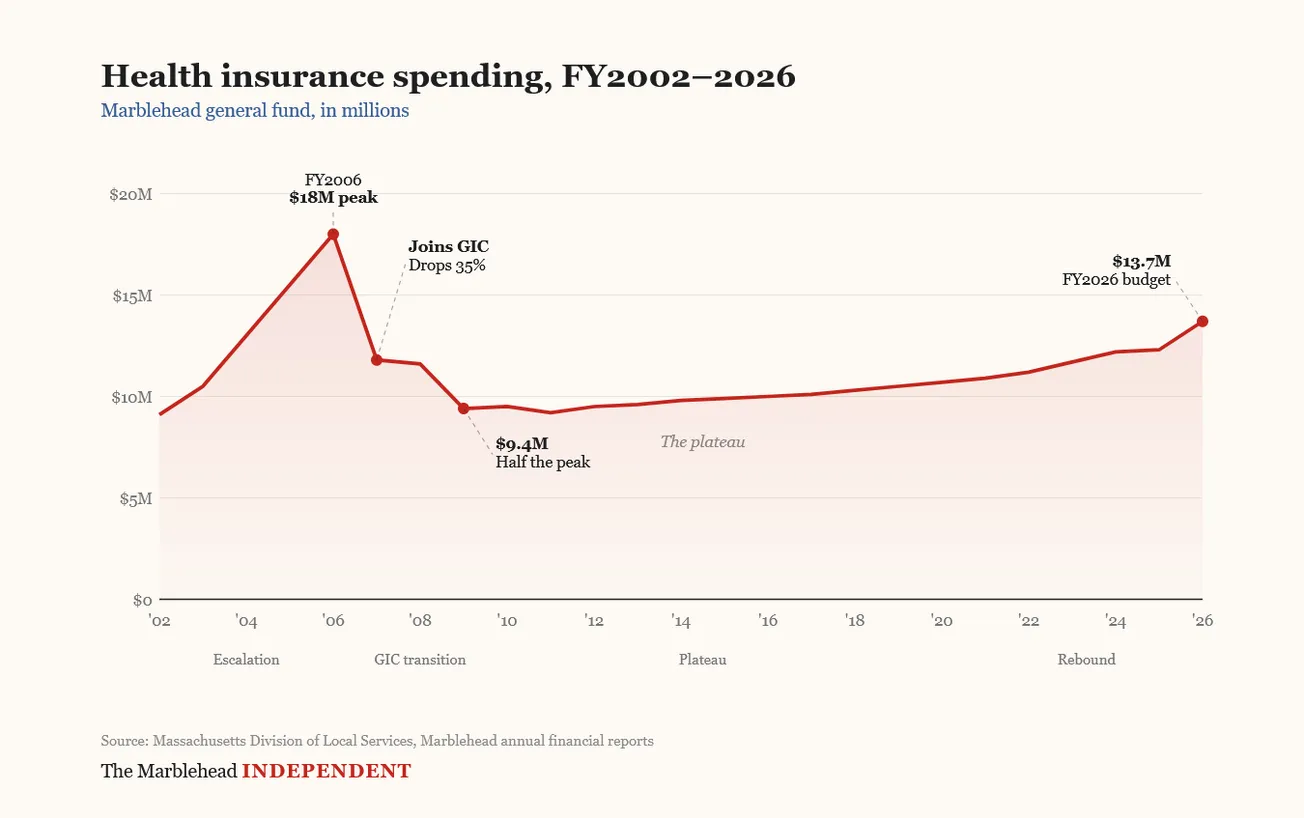

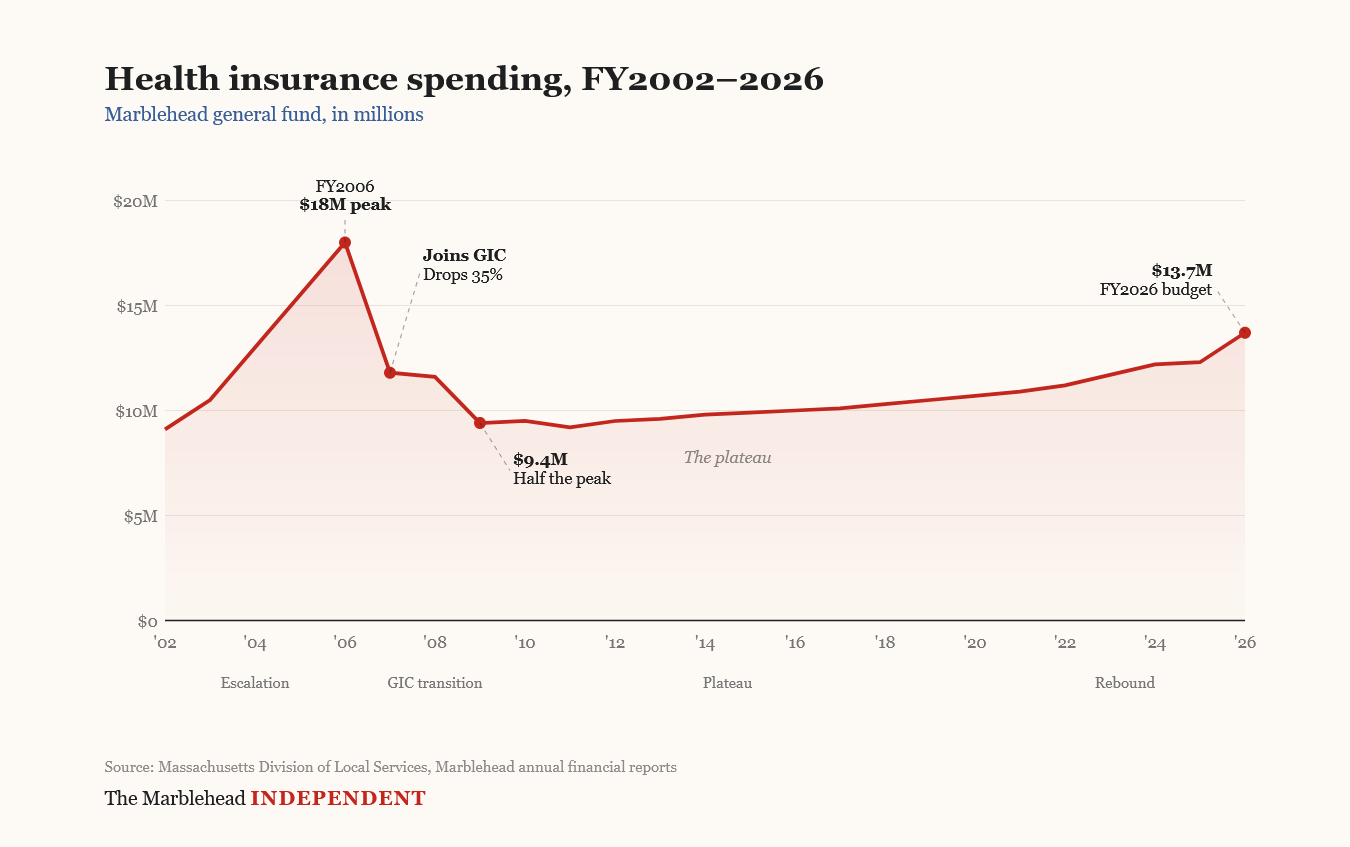

EDITOR'S NOTE: Health insurance is one of the biggest (and fastest-moving) pressures on Marblehead’s general fund. Before you dive into the story, take a minute with the interactive below, which tracks the town’s health-insurance spending across 21 fiscal years—from the mid-2000s peak, through the savings that followed the shift to the Massachusetts Group Insurance Commission (GIC), and into the recent stretch of renewed cost growth. Click here to explore the interactive chart, and hover over bars to see dollar amounts.

When Marblehead’s annual health insurance bill hit $18 million in 2006, the figure represented the peak of a cost spiral that had nearly doubled municipal spending on employee and retiree coverage in just four years.

A year later, the town joined the state Group Insurance Commission, a state agency that pools public employees from participating municipalities to negotiate health plans. The bill dropped to $11.8 million. By 2009, it had fallen to $9.4 million — roughly half the peak.

For a decade after that, health insurance barely moved. The general fund kept growing. The share kept shrinking. By 2019, health insurance had dropped to 12.6 percent of the budget. Room opened up for everything else.

That era is ending.

Finance Director Aleesha Benjamin breaks health insurance into two categories: active employee plans and Medicare supplements for retirees. She confirmed that Marblehead spent $12.3 million on health insurance in fiscal 2025 — $9,944,018 for active employees and $2,378,190 for retirees. For fiscal 2026, the town budgeted $13.6 million. The budget share climbed to about 14.1 percent of the operating budget, the highest since the early 2010s.

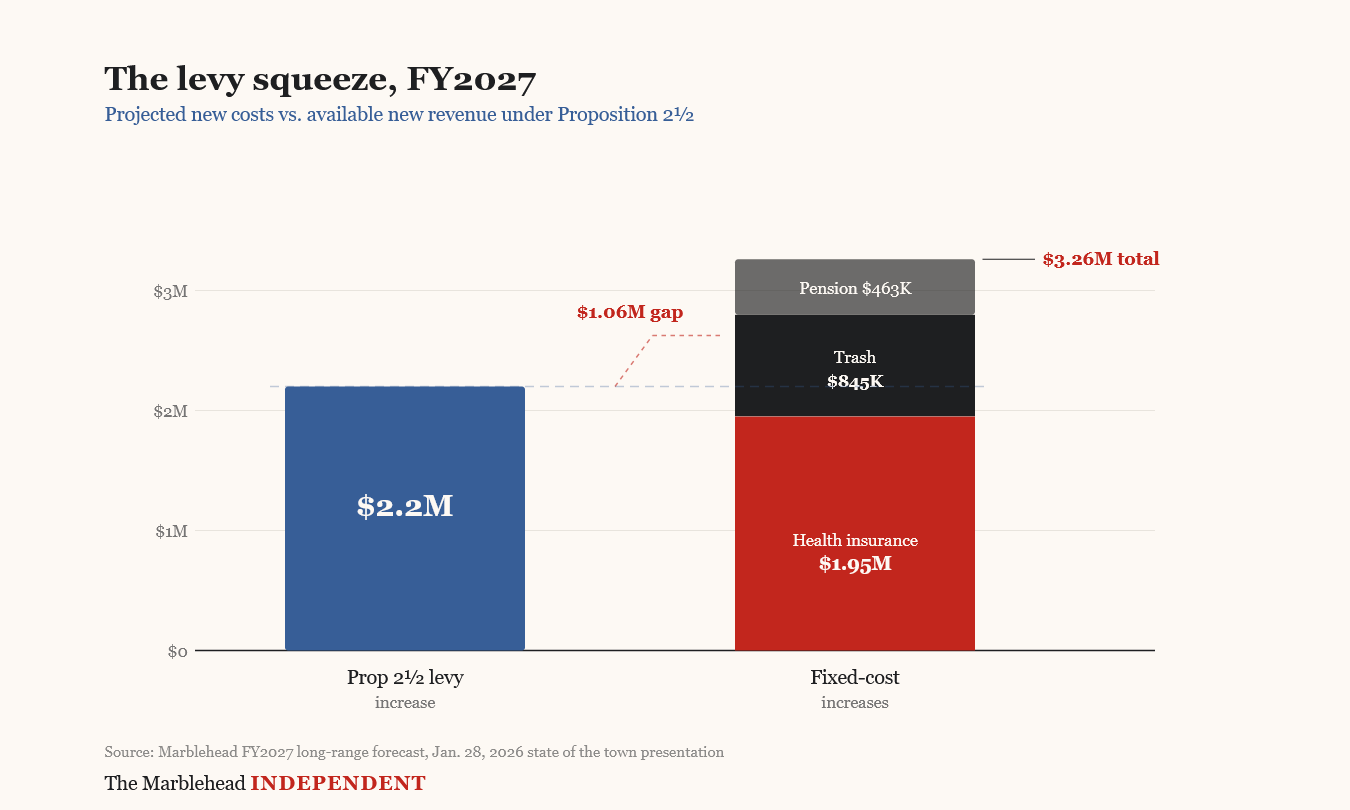

If costs rise 15 percent in fiscal 2027, as the long-range forecast assumes, the increase alone would approach $2 million.

"There are mandatory, mandatory cost drivers, like insurance benefits, trash, that are having significant increases that are mandatory, which are going to force us to make cuts in other areas of municipal government," Town Administrator Thatcher Kezer said. "Just because we have nowhere else to go."

Benjamin put the math simply.

"At 15 percent, the increase is almost $2 million," she said. "It eats it all."

She meant the levy. Under Proposition 2½, Marblehead's property tax can rise by about $2.2 million a year. Health insurance alone could consume nearly the entire increase.

Kezer confirmed it.

"The two and a half number is round number $2.2 million," he said. "The 15 percent increase scenario is 1.9 in change, just under 2 million. So nearly all of the prop two and a half increase is being taken by health insurance."

He paused.

"And it's not just Marblehead. It's every municipality. It's every business."

Four eras

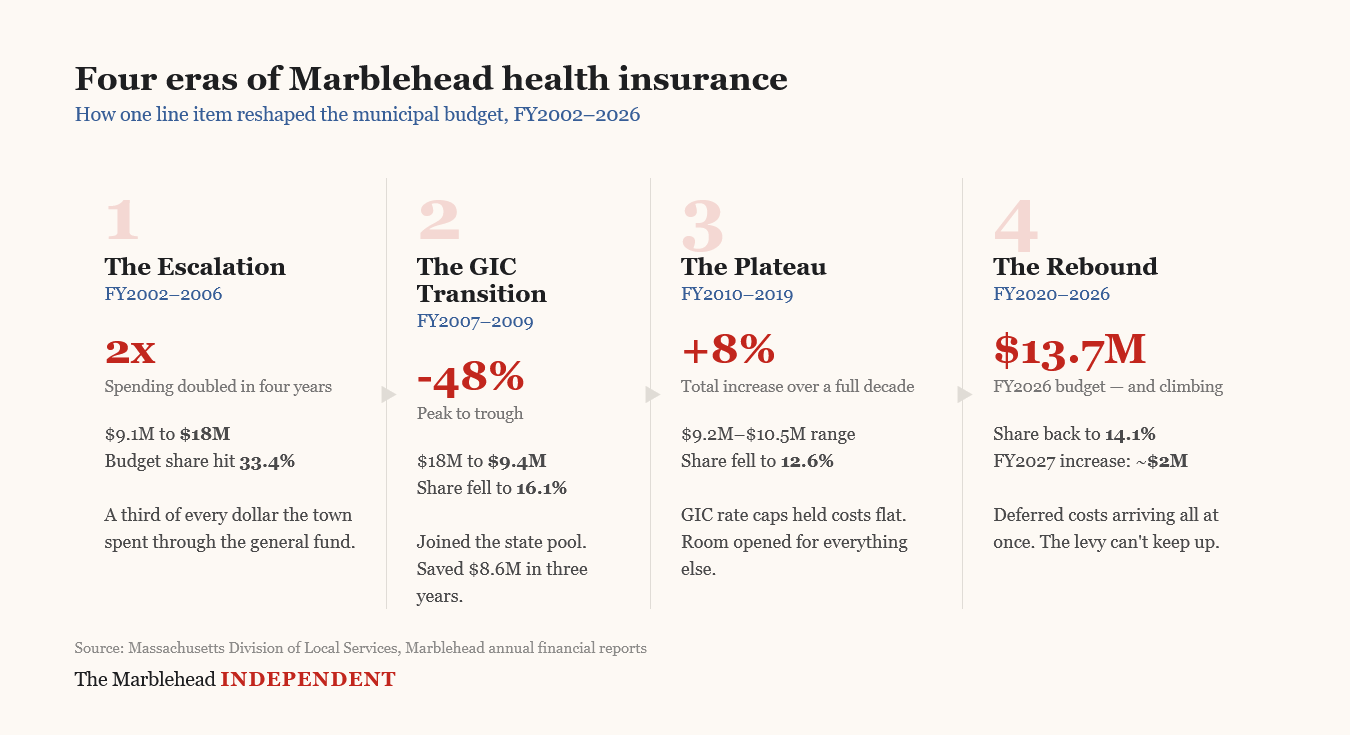

State data trace Marblehead's health insurance spending from fiscal 2002 through 2024. Annual financial reports supply total general fund figures starting in 2004. Together, the records reveal four distinct cost regimes.

The escalation came first. Spending doubled between 2002 and 2006 — from $9.1 million to $18 million. The budget share hit 26.5 percent in fiscal 2004, rose to 30.4 percent in 2005 and reached 33.4 percent in 2006. A third of every dollar the town spent through the general fund.

The most dramatic single-year change came between fiscal 2006 and fiscal 2007, when Marblehead joined the GIC. The larger the pool, the more leverage. Spending dropped from $18 million to $11.8 million — a decrease of roughly $6.2 million, or 35 percent.

"The more you can have together, the more pooling, the better to offset those communities that maybe don't have good loss ratios against those communities that do," Benjamin said. "That's how they're able to offer the lower rates."

The savings compared to the alternative remain significant. Benjamin said municipalities that stayed with private insurers saw a 20 percent increase the year before fiscal 2025, versus 12 percent for GIC communities. In fiscal 2025, the gap widened: the Massachusetts Interlocal Insurance Association forecast a 23 percent increase while the GIC projected 15 to 18 percent. Eleven additional communities joined the GIC for that cycle.

Spending continued falling after the transition — to about $11.6 million in fiscal 2008 and roughly $9.4 million in 2009. From peak to trough, the reduction amounted to approximately $8.6 million, or 48 percent of the 2006 peak. The budget share fell from 33.4 percent to 16.1 percent in three years, freeing resources for every other municipal function.

Then came the plateau. From fiscal 2010 through 2019, health insurance entered a period of comparative calm. Spending fluctuated between roughly $9.2 million and $10.5 million. Over the full decade, it rose only about $775,000 — roughly 8 percent. For a line item that had doubled in four years, this was stability.

Because the general fund grew steadily while health insurance stayed flat, the share kept declining: from about 15.7 percent in 2010 to 12.6 percent in 2019.

The bill comes due

That long plateau, Benjamin suggested, was itself part of the problem now arriving. The GIC had negotiated caps on how far rates could climb, keeping annual increases in the low single digits. But those caps meant premiums never kept pace with the underlying cost of care.

"Those incremental increases that should have been occurring were not, because they just stayed within that threshold," Benjamin said. "And now we're catching up to where we should be, but all at once."

Beginning in fiscal 2020, spending resumed an upward trend. From about $10.7 million in 2020, costs rose to $12.2 million in fiscal 2024 — an increase of roughly $1.7 million, or about 16 percent over the 2019 base. The budget share barely moved through that stretch, holding between 12.1 and 13.1 percent because the general fund was growing at a similar pace.

Get our free local reporting delivered straight to your inbox. No noise, no spam — just clear, independent coverage of Marblehead. Sign up for our once-a-week newsletter.

The inflection arrived in fiscal 2025 and accelerated into fiscal 2026. Town Meeting adopted a budget totaling about $107 million for fiscal 2026, including debt service and warrant articles. The operating portion — town departments and schools — came to roughly $97 million. A decade-long downward trend in health insurance's share reversed.

The final cost depends on which plans employees choose. The GIC offers a menu — Harvard Pilgrim, Tufts, Mass General Brigham and others. Each has its own rate trajectory. Employees pick during open enrollment in April, weeks before the budget must be finalized for Town Meeting.

"The real number that needs to be calculated is we have all our employees who decide, out of the eight plans, or whatever the number is, of plans they're going to participate in that have different cost amounts," Kezer said.

A manageable headline rate can mask a much larger actual increase.

"So if you just apply a 14 percent general number," he said, "this health plan which has 50 employees, and it may be going up 25 percent, and this health plan that has eight employees is only going up 6 percent, we're getting hammered more than the 14 percent."

By law, Marblehead must negotiate cost-sharing splits with a public employee committee. The town has no control over plan design or premium rates — only over how the cost is divided between employer and employee. Currently, the town pays 83 percent of premiums on most plans.

What comes next

Benjamin said insurance professionals are projecting sustained increases across both public and private employers — anywhere from 23 to 26 percent in the private commercial market, with GIC municipalities expecting double digits for the next two to three years.

"When the actuary came in, he said I was kind of low for what he had heard," she said.

The long-range forecast projects a widening structural gap: roughly $8.4 million in fiscal 2027, $11 million in fiscal 2028 and $15 million in fiscal 2029. Those projections assume health insurance increases of 15 percent in fiscal 2027, then 5 percent in each of the following two years.

At the Jan. 28 state of the town presentation, Kezer framed health insurance alongside two other fixed-cost drivers: a new trash contract adding $844,575 and a pension increase of $462,735. With health insurance estimated at $1,951,708, the three items total about $3.26 million in new costs.

The levy generates about $2.2 million.

"This is the perfect storm hitting us," Kezer told the Select Board.

Without an override or new revenue, he said, the town would need to eliminate more than 50 positions — roughly 15 percent of the workforce — and limit services to only the most critical functions. The last time Marblehead passed an operating override was 2005.

Officials hear every year that the budget feels different. Kezer said this year the math has changed.

"We sucked up every seat cushion we had to pull together the dollars we need to make it work," he said. "That's our job. Is to pull it together. This year it's not there. The dollars are just not there."

He wasn't finished.

"Our revenues have fallen, and we're getting hit with extraordinary cost increases that are outside our control."

The 21-year record tells a clear story. Health insurance went from consuming a third of Marblehead's general fund in 2006 to roughly one-eighth by the late 2010s. The GIC transition made it possible. A decade of flat costs sustained it. That decline created room for every other category of municipal spending to grow. Schools, public safety and public works all benefited from health insurance taking a smaller bite.

Now the share is climbing back. Whether the fiscal 2027 budget absorbs the impact through service cuts, new efficiencies or additional revenue remains an open question. The two-decade record makes clear this is not an anomaly but a recurring feature of how Marblehead's municipal budget works.

Marblehead’s budget choices often turn on a few numbers most people never see clearly. This week, The Marblehead Independent traced the town’s health insurance costs over two decades. If costs rise 15 percent in fiscal 2027, the increase alone nears $2 million — against a Proposition 2½ levy increase of about $2.2 million. We report this so residents can understand what’s driving the tradeoffs, with coverage that stays free and open to all. If you value that work, we invite you to become a supporting member. Click here to become an Independent member.